Blog

Fast value creation with Finance First approach in ERP transformations

Most likely your company is looking more frequently into financial data and analytics than few years ago, correct? And one the key sources of that data is the ERP (enterprise resource planning) system. Read on to make sure that at the time of ERP transformation or implementation, you have the tools to go finance first, maintain visibility and control on financials all the time and create value faster.

We see that companies have been and are pushed to take a leap in modernizing their systems, including ERP. Even mentioning the words “ERP implementation project” or “changing ERP” makes many of us sweat in despair. It is true that those projects take usually a lot of time, money and involve what feels sometimes as too many stakeholders. While we are not able to take the full weight off of your shoulders, we can propose that you approach the project “finance first” to get business insights and return on investment faster.

What does Finance First approach mean in ERP implementation or transformation projects?

Quoting Gartner: A Finance First ERP strategy first deploys the financial management suite to enable more rapid consolidation of financial results and creates impactful key performance measurements.

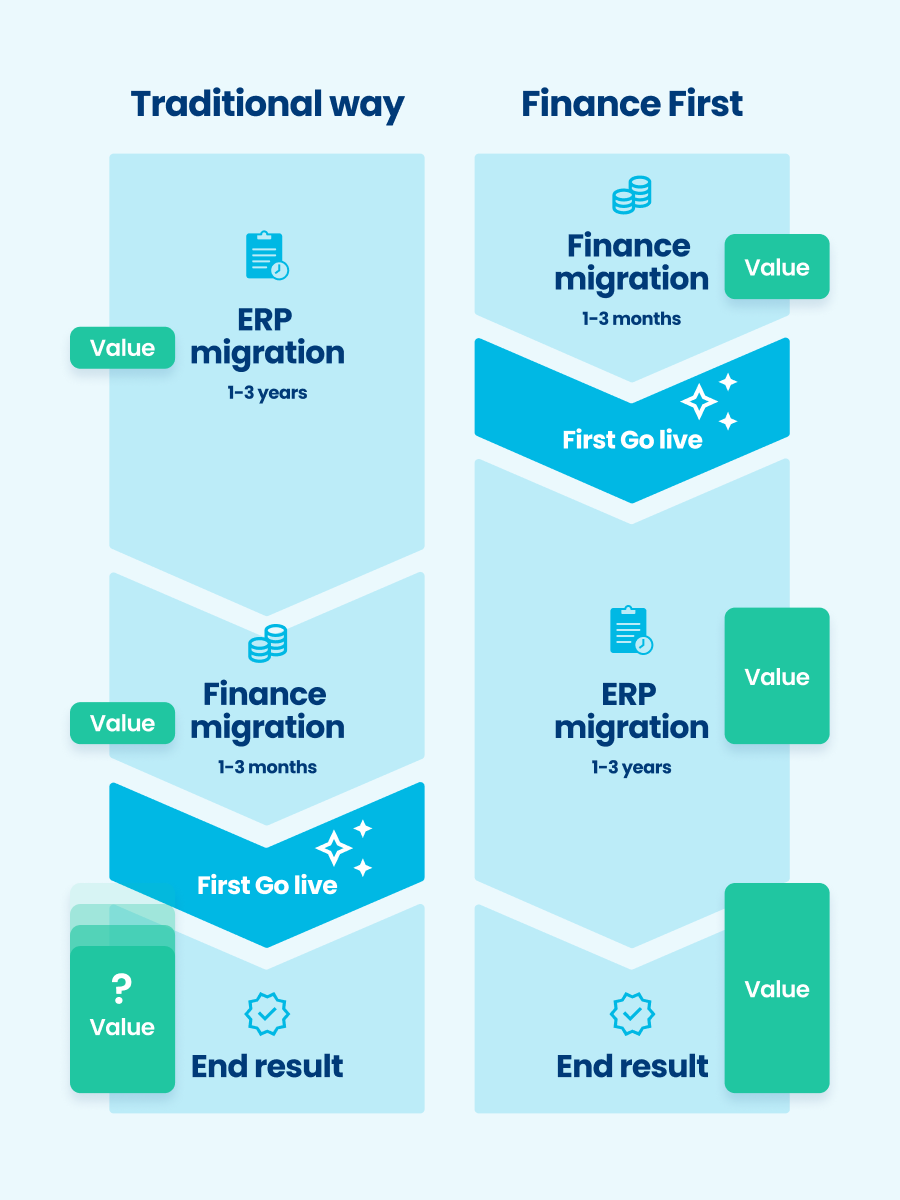

In practice, the financial module is prioritized over others to ensure that accurate data is available throughout the ERP system implementation or transformation. This means that the first business critical go-live can happen quickly, in 1-3 months, with the financial module.

The approach isn’t completely new, but many companies might not be fully aware of the option besides the more traditional approaches. The three main strategies for ERP transformations are

- The big bang: launching everything at once and closing the old one,

- old and new system run parallel for some time before the old is ramped down and

- segmenting organization and transforming modules one by one.

Finance First falls under the third one, but it has been more common to start from e.g. HR. Reasoning usually is that HR is a smaller and less complex entity, making it a good candidate for the first run. While sometimes it makes sense, there could be more benefits in going finance first.

What are the benefits of finance first approach?

In a nutshell, you are able to faster get your financial data up and running in the new system, allowing continuous monitoring of financials during the ERP project and making sure that the data is of good quality right from the start. This in turn means that you get reliable and accurate business insights faster. The more insights you have, the better your company can ensure the goals of the ERP projects are achieved and, in the end, make decisions that support strategic goals.

If the ERP transformation is done in a more traditional way, accurate financial data is only available at the very end of the project. This in turn means that value is achieved slower and it is more difficult to validate that the end result of the ERP project will be what it needs to be. There is more uncertainty compared to Finance First approach.

Integrations between ERP and financial management systems become integral – what if you wouldn’t have to worry about them?

When considering changes in enterprise resource planning and financial management software, for example for invoicing, it is good to keep in mind that the ERP provider doesn’t have to be the sole provider of solutions you need. It is becoming more and more common to go with so called “best-in-breed” solutions, which allows you to pick and choose even niche software what best suits your needs and business cases. It could be for example that you will have to meet the invoicing regulations of multiple countries. In these cases especially, integration is the key.

There is no need to wait for years to see the financial data after a massive transformation project, but you get reliable view on financials first.

So, the scenario could be that you have made the decision to change the ERP system and the financial management module will be a separate entity from that. The best approach would be to first integrate the financial management solution to the old ERP system and so get the finances and data rolling. Then, when the time comes, you could integrate financial module to the new ERP system just in few days. No need to wait for years to see the financial data after a massive transformation project, but you get reliable view on financials first.

That’s what Heeros ERP Connector service is created for, to help companies do transformations finance first and thus, to be able to make more accurate strategic business decisions. Our standardized integration packages and integrations team with extensive knowledge working on the projects allow you focus on the core operations.

Added value in months, not years

With ERP connector service, integrations become the least of your concerns.

Time to boost your business?

Let's start by going through your current situation and needs, and then proceed towards the most suitable solution for you. Book a meeting with our sales or reach out to us by filling the form.